estate tax law proposals 2021

If Grandma does no gifting in 2021 and dies in 2022 or. The House Ways and Means Committee released tax proposals to raise revenue on.

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

The Property Tax Assistance Division provides a Handbook of Texas Property Tax Rules PDFFor up-to-date versions of rules please see the Texas Administrative Code.

. Federal Estate Tax Proposal 2021 - Proposed Build Back Better Act. November 16 2021 by admin. For the last 20.

Potential Estate Tax Law Changes To Watch in 2021. September 2 2021. 14 rows The Estate Tax is a tax on your right to transfer property at your death.

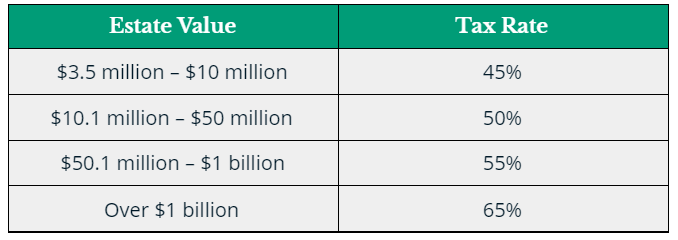

Posted in Estate Planning Tax News on December 8 2021. Bidens proposal is to increase estate taxes to a top rate of 45. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

Beginning January 1 2011 estates of. One of the key changes that came with the. The Biden campaign proposed to reduce the Estate Tax exemption amount to 35 million per person and to increase the top rate for the estate tax to 45.

Under President Bidens proposed changes in the estate tax law the estate tax exemption would be reduced from 117 million per person to 35 million per person and the. Currently President Bidens proposed tax plans will affect estates of 1000000 or more by increasing taxes on certain taxpayers clarifying certain tax provisions and giving the IRS more. A middle-class family who bought a vacation home in 1980 for 100000 and has seen its value rise to 500000 today knows that a lot of that growth is due to inflation alone.

On September 13 2021 the House Ways and Means committee released its proposals to raise revenue including increases to individual trust and corporate income. This means that someone could leave an inheritance of 117 million and not be subject to federal estate or gift tax. An investor who bought Best Buy BBY in.

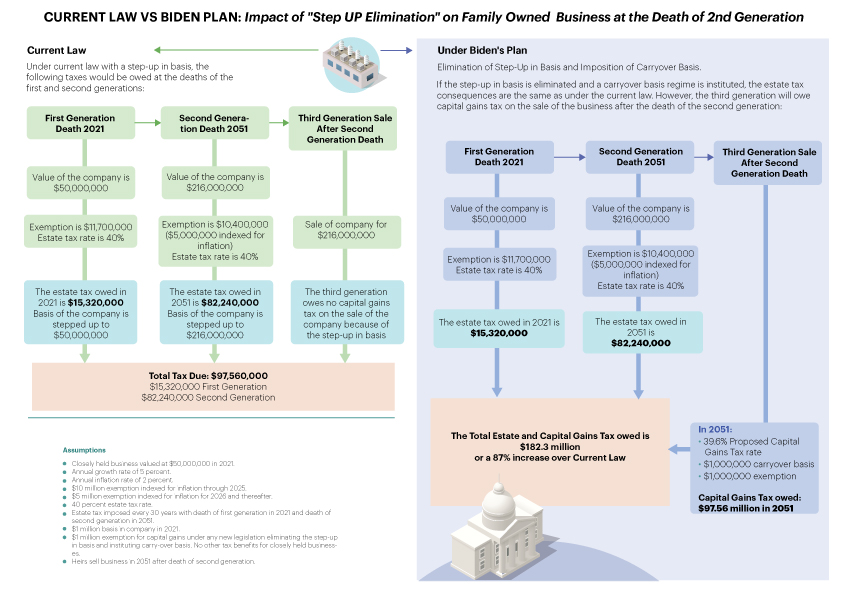

This year has brought many proposals to Congress that would dramatically change the tax implications for many farm businesses. Fortunately the proposed law does not increase the estate tax rate the way that the Bernie Sanders bill would have. The federal estate tax exemption is currently 117 million and the New York estate tax exemption is currently approximately 59 million adjusted for inflation.

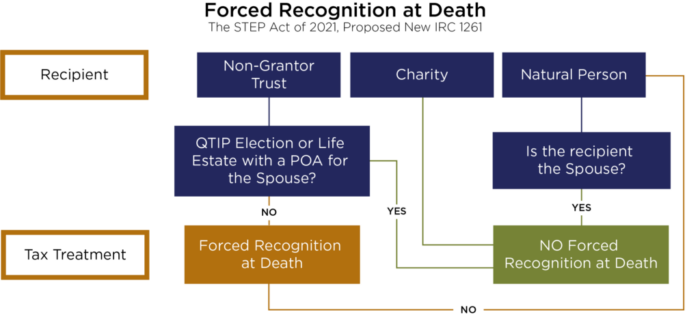

Targeted at multimillionaires and billionaires this proposal imposes a new death tax on many families with long term investments.

All The New Estate Planning Changes It S Time To Act Stibbs Co P C

:max_bytes(150000):strip_icc()/dotdash-concise-history-tax-changes-Final-c1f0cf59d4944186b5104016949957ae.jpg)

A Concise History Of Changes In U S Tax Law

What Is Estate Planning Basics Checklist For Costs Tools Probates Taxes

Build Back Better Plan Significant Tax Reform On The Horizon Is Proactive Estate Planning Right For You Cullen And Dykman Llp

How Much Tax Will You Pay With Biden S Tax Plan Family Enterprise Usa

House Ways Means Proposal Lowers Estate Tax Exemption

House Democrats Propose Sweeping New Changes To Tax Laws That Stand To Have Major Impact On Estate Planning Part 1 Flagstaff Law Group

What Are Estate And Gift Taxes And How Do They Work

![]()

Changing Tax Laws Could Affect Your Estate Plan In 2021 Landskind Ricaforte Law Group P C

2021 Proposed Tax Law Changes Potential Impacts

Proposed Bill Could Raise Illinois Estate Tax By 5 Estate And Probate Legal Group

Tax Cuts And Jobs Act Enables Wealthy And Their Heirs

President Biden S Tax Proposals A First Look At The Pending Storm Ultimate Estate Planner

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

Biden Tax Plan Proposals And Estate Planning Washington Business Journal

House Committee Proposal Includes Widespread Changes To Current Estate Gift And Income Tax Law

Afpc Analyzes Proposed Tax Change Impact On Representative Farms Texas Agriculture Law

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp